how much tax is taken out of my paycheck in san francisco

Web Are California residents are subject to personal income tax. Proposition F fully repeals the.

1099 Tax Calculator How Much Will I Owe

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income.

. Web The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Web If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends. Web Heres what you need to know about California payroll taxes and paycheck laws.

Lean more on how to submit these. If you received a letter from the. Web How old are you.

Web Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Depending on your type of business you may need to pay the. Web If you make 70000 a year living in the region of California USA you will be taxed 15111.

If your monthly paycheck is 6000 372 goes to Social. Web Why is so much taken out of my paycheck. To find out how.

If your income is. Web For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Web 27 rows These are contributions that you make before any taxes are withheld from your paycheck.

Web How much a person receives from a 1200 dollar paycheck depends on how many exemptions you have and what deductions you can take on your income taxes. Web 91 rows Brief summary. That means that your net pay will be 43324 per year or 3610 per.

Web If you find yourself always paying a big tax bill in April take a look at your W-4. Yes residents in California pay some of the highest personal income tax rates in the United States. Web Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

One option that you have is to ask your employer to withhold an additional dollar. California state payroll taxes. Web Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business.

Web HB 2119 2019 requires employers to withhold income tax at a rate of eight 8 percent of employee wages if the employee hasnt provided a withholding statement. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. If you make 55000 a year living in the region of California USA you will be taxed 11676.

If your business stops operating you must tell the City. Taxpayers can choose either itemized. The amount taken out is based on.

Just enter the wages tax withholdings and other. Apply to waive or cancel tax penalties and fees including late payment penalties. Federal deductions The largest withholding is usually for federal income tax.

Web You may elect to file your taxes only at the end of the year even if your job hasnt taken out taxes from your paychecks. Your average tax rate is 1198 and your marginal tax rate is 22. Web 27 rows So if your income is on the low side youll pay a lower tax rate than you likely would in a.

The income tax rate ranges from 1 to 133. What income is tax free. Web Gross Receipts Tax and Payroll Expense Tax.

How To Pay Little To No Taxes For The Rest Of Your Life

2022 Federal State Payroll Tax Rates For Employers

Here S How Much Money You Take Home From A 75 000 Salary

If You Make 150k Per Year In California What Percent Of That Money Goes To Taxes Quora

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Free Llc Tax Calculator How To File Llc Taxes Embroker

The Next Battle In California S Housing Crisis Should Cities Tax Empty Homes

The Difference Between Living In Nyc Living In San Francisco

Are S F Landlords Sitting On Tens Of Thousands Of Empty Homes Vacancy Tax Could Put Debate To Rest

Sf To Pay Low Wage Workers Who Get Covid 19 To Stay Home And Isolate

Raise My Taxes Now The Millionaires Who Want To Give It All Away The Super Rich The Guardian

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

Here S How Much Money You Take Home From A 75 000 Salary

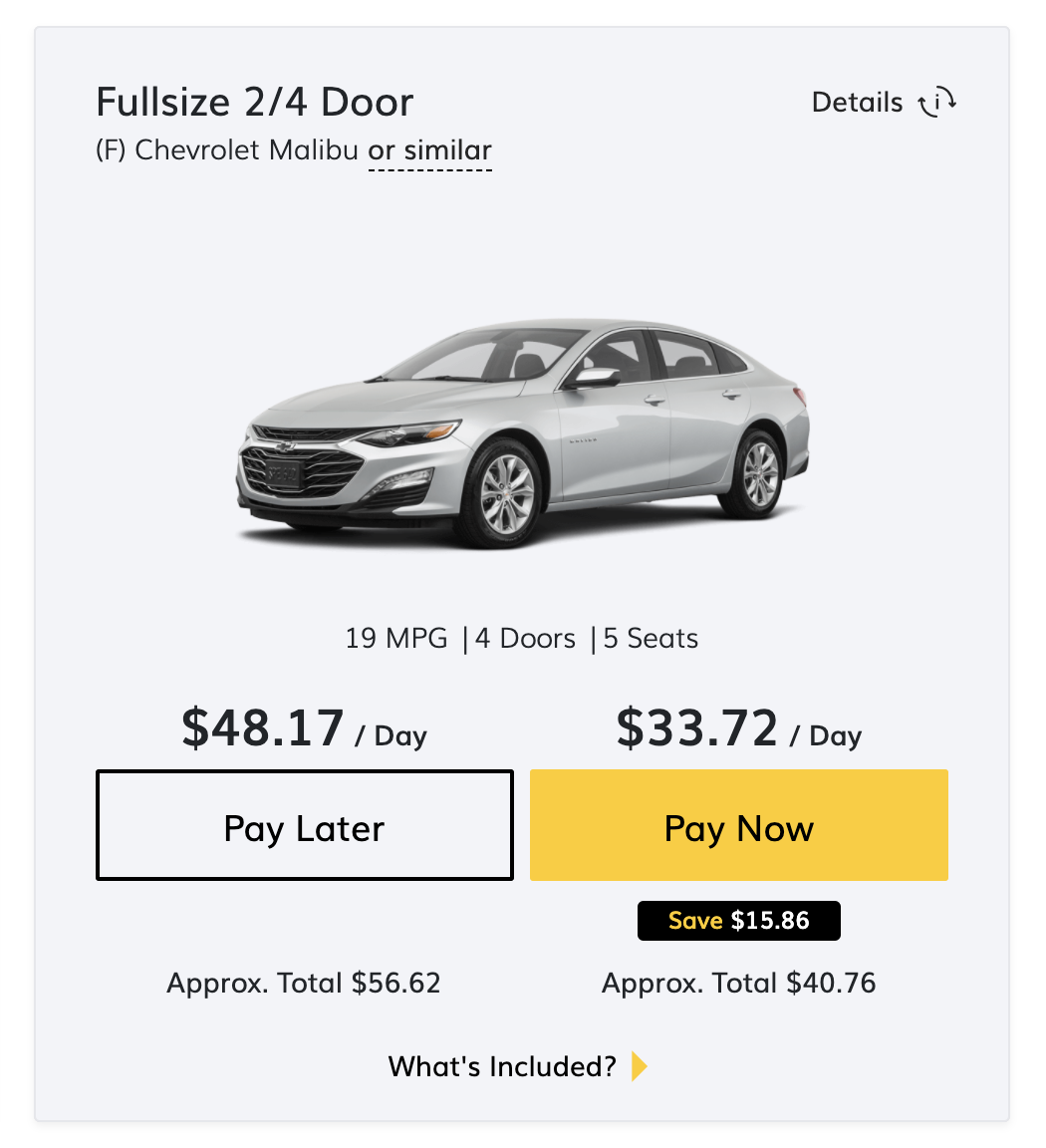

Pre Pay Car Rental Pay Now And Save Hertz

As Rideshare Prices Skyrocket Uber And Lyft Take A Bigger Piece Of Riders Payments Mission Local

Doordash 1099 Taxes And Write Offs Stride Blog

W 4 Form What It Is How To Fill It Out Nerdwallet

Can My Tax Refund Be Taken By The California Franchise Tax Board Ftb To Pay Off Debt